FIN Insurance Increases Profit to N7.1bn in 2023, Strengthens Relationship with Brokers

Leading underwriting firm, FIN Insurance Company Limited, has sustained its growth milestone with increase in profit from N649, 568 million in 2022 to N7.1billion in the 2023 financial year, with total assets rising to N21.1 billion when compared to N12.7 billion achieved in 2022.

FIN Insurance gross premium also recorded a 69.1% increase from N3.4 billion in 2022 to N5.8 billion in year 2023. The shareholders fund appreciated to N15.5 billion as against N9.8 billion in 2022 while solvency margin was N12.5 billion when compared to N8.5 billion reported in 2022.

The company also committed a total of N1.2 billion as claims to policyholders in 2023 and achieved an underwriting profit of N0.2 billion in the year under review with the growth attributed to stronger business relationships with its customers most especially the brokers fraternity.

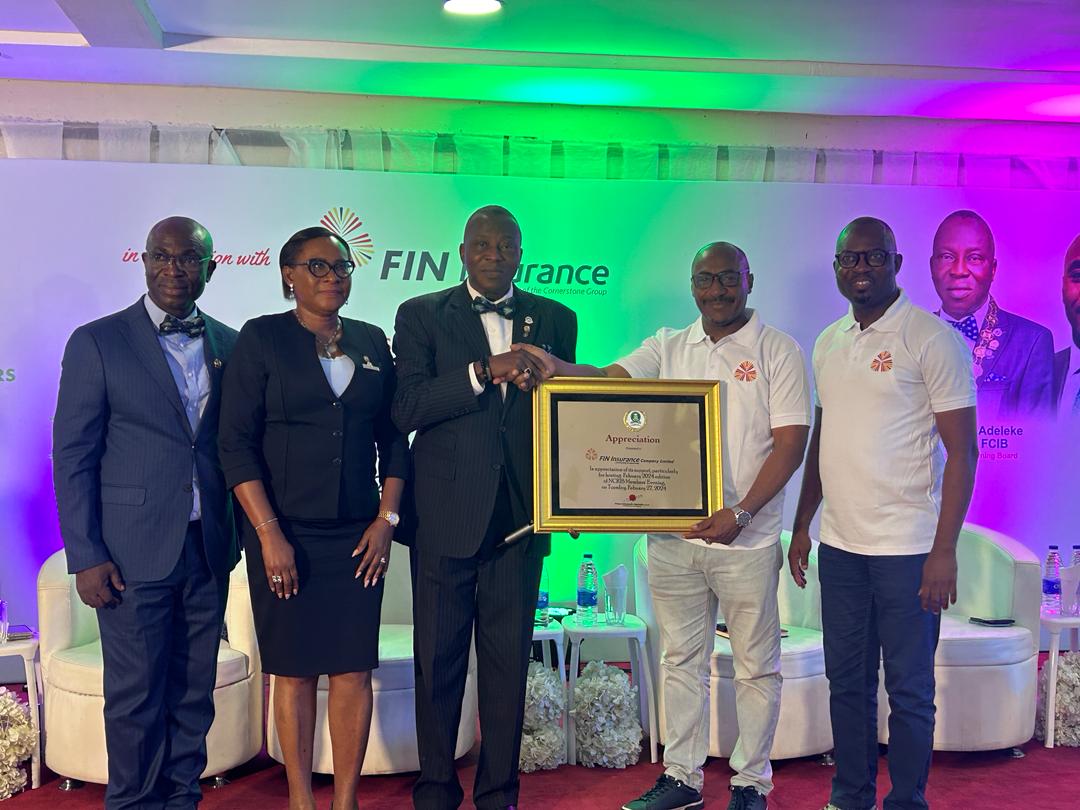

Speaking at the first bi-monthly NCRIB member’s evening of 2024 hosted by the company on 27th February 2024, in Lagos, the Managing Director Mr. Bashir Binji, reiterated the company’s commitment to business growth and building stronger partnership with the insurance brokers.

“At FIN Insurance, we recognize the integral role that brokers play in bridging the gap between insurers and clients. Your insights, relationships, and commitment to understanding the unique needs of your clients contribute significantly to the success of our industry.

“As we navigate this complex landscape, collaboration becomes paramount. Our success as an industry is interwoven with the success of each individual broker. It’s about working together to innovate, to respond to emerging risks, and to embrace new opportunities,” he said.

He further pledged to develop specialty products to support the brokers, assign individual responsibility to their portfolio and provide risk management support to brokers and their clients.

“There is going to be further improvement within our technical and technology teams to continuously improve our capacity to serve our partners. This will help increase the proportion on existing transactions, enhance information sharing, and joint marketing in areas of interest as well as boost social engagements’’, he concluded.

In his inaugural address, the president of NCRIB, Mr. Babatunde Oguntade advised the federal government and all other agencies to rise to the challenge of tackling the issue of food scarcity affecting the country.

“One of the factors responsible for food scarcity, aside from the continuous rise in foreign exchanges, influence of hoarders and unscrupulous elements within the system, is the issue of insecurity, particularly the indiscriminate killings of our farmers.

“This made it impossible for them to produce enough farm products to care for the nation. It is on this premise that our Council join other well-meaning Nigerians to appeal to the federal government and the Nigerian Service Chiefs to, as a matter of urgency, investigate the issue of insecurity and doggedly pursue its avowed commitment towards re-establishment of forest rangers and of course, state policing.” he said.

The NCRIB Member’s Evening is a monthly gathering that joins registered insurance brokers and other stakeholders through engaging events, symposiums and discussions on issues affecting the insurance industry.

FIN Insurance Company Limited (formerly, Yankari Insurance Company Limited) was incorporated on 24th April 1981 as a limited liability company wholly owned by the Bauchi State Government. It was registered as a licensed insurer in 1982 and commenced business on the 1st of January 1983. The company was then acquired by FIN Bank Plc and had its name changed to FIN Insurance Co. Ltd in 2008. In 2012, FIN Bank was taken over by First City Monument Bank (FCMB) while FIN Insurance subsequently became a member of the FCMB Group.

2014 saw the acquisition of FIN Insurance by Cornerstone Insurance Plc (via CAPE III Limited) with the National Insurance Commission (NAICOM) authorizing this change in 2015, hence making the business a member of Cornerstone Group. As of December 31, 2023, the company recorded a gross premium income of over N5.814billion from N3.438 billion in 2022 representing a growth of 69.1 percent. Total assets increased to N21.14 billion while shareholders fund rose to N15,532 billion.

Photo Caption

L-R: Edet Udoh, Assistant General Secretary, Nigerian Association of Insurance and Pension Editors (NAIPE); Matthew Otoijegha, Financial Secretary, NAIPE; Nkechi Naeche-Esezobor, Chairperson, NAIPE; presenting a copy of NAIPE Trumpet to Mr Jude Modilim, Managing Director/CEO, Zenith General insurance; Dolapo Talabi, Head, Corporate Communications, Zenith General; Mrs Rosemary Iwunze, General Secretary, NAIPE and Mrs Amaka Obiefuna, Public Relations Officer, NAIPE, during NAIPE’s Executive visit to Zenith General Insurance in Lagos on Thursday, March 14, 2024.