Diaspora remittances up 79% to $4bn in 9M’24 — Cardoso

Diaspora remittances through International Money Transfers Operators (IMTOs) rose massively to $4.18 billion in the first three quarters of 2024 (9M’24), about 79.4 percent above the $2.33 billion in the same period of 2023.

Diaspora remittances through International Money Transfers Operators (IMTOs) rose massively to $4.18 billion in the first three quarters of 2024 (9M’24), about 79.4 percent above the $2.33 billion in the same period of 2023.

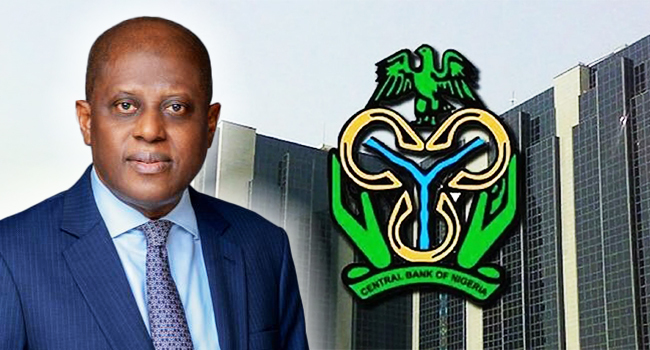

Governor of the Central Bank of Bank (CBN), Mr. Olayemi Cardoso, disclosed this at the Monetary Policy Stakeholders Forum, in Abuja, yesterday.

He attributed the positive development to the various reforms introduced by apex bank in the past one year.

He stated: “Beyond monetary policy, the bank undertook critical reforms to strengthen the financial system and ensure macroeconomic stability.

“This reform yielded tangible results, with remittances through IMTOs rising 79.4 percent in the first three quarters of 2024 to US$4.18 billion, compared to US$2.33 billion in the same period of 2023.”

The CBN boss said the past year presented significant challenges, including persistent inflationary pressures exacerbated by global and domestic shocks.

He explained: “The liquidity injections associated with unorthodox monetary policies, particularly since the COVID-19 pandemic, have created a significant overhang. While these measures were intended to cushion immediate shocks, they did not translate into commensurate productivity growth, fueling inflationary pressures and heightened foreign exchange volatility.

“Excess naira liquidity in the system has amplified demand-driven inflation, further exacerbated by supply-side constraints stemming from structural deficits. These dynamics underscore the importance of a disciplined and coordinated approach to monetary policy to restore stability.

“In response, the Monetary Policy Committee initiated a tightening cycle using orthodox approaches. Throughout 2024, the bank implemented several bold policy measures across six MPC meetings, including raising the Monetary Policy Rate (MPR) by a cumulative 875 basis points to 27.50 percent, increasing the Cash Reserve Ratio (CRR) of Other Depository Corporations (ODCs) by 1750 basis points to 50.00 percent, and adjusting the asymmetric corridor around the MPR.